Wio Invest, a leading UAE investment platform owned by ADQ sovereign wealth fund, which announced that it has surpassed $1 billion in assets under administration also noted that most popular investment themes, are US tech stocks such as NVIDIA and Tesla, and crypto space which includes, Bitcoin (BTC), Ethereum (ETH), and XRP. remain They also noted that other favorites included companies such as MicroStrategy (MSTR) that are heavily invested in the crypto space.

According to the press release, this achievement positions it among the fastest-growing digital investment platforms globally, on par with leading neo brokers at similar stages in their journey. Wio Invest has evolved to meet the changing needs of a new generation of investors expanding access to now include UAE markets, virtual assets, and wealth management portfolios.

“This latest milestone reflects our commitment to reimagining everyday investing, and we’ve worked hard to build a platform that makes it simpler, smarter, and more accessible for everyone,” said Gaurav Ganwani, Deputy General Manager at Wio Securities LLC.

He added, “We are passionate about empowering individuals to build long-term wealth through intuitive investment solutions, with a core focus on instant access. Through Wio Invest’s integration with Wio Personal, users can open an account in minutes, invest directly from the app, and benefit from the instant settlement of sell orders.”

Wio Invest has seen more than $4 billion in order volume year-to-date, driven by a new wave of investors who are more digitally native, financially curious, and focused on building their futures.

The platform has also seen solid growth in its recurring orders feature, with index funds emerging as a top choice, reflecting a growing appetite for consistent, long-term investing.

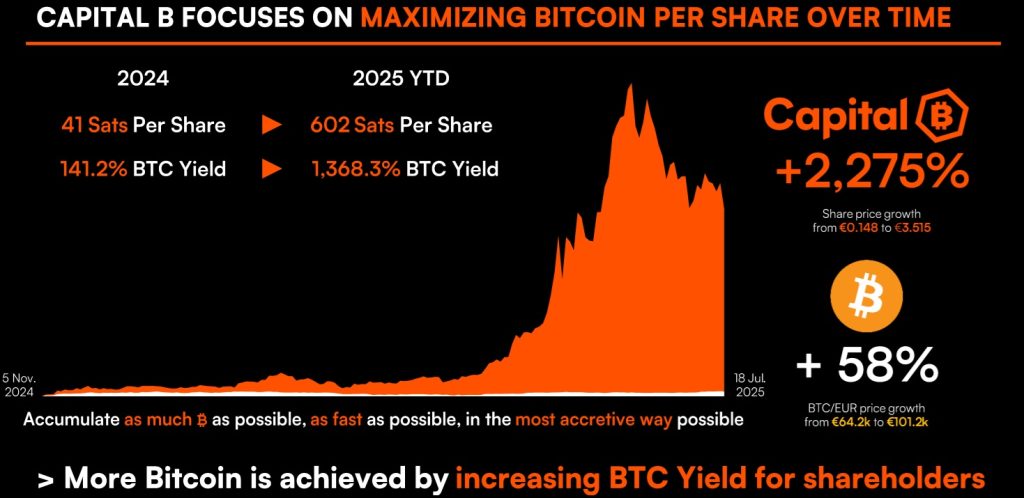

This comes as entities such as DeFi Technologies enters the MENA region with offices in UAE to offer digital asset ETPS on financially regulated exchanges such as Abu Dhabi Exchange, Dubai Financial Exchange and others in Qatar, KSA, Oman and Bahrain. DeFi Technologies, a financial technology company bridging the gap between traditional capital markets and decentralized finance, expanded its operation into the GCC and MENA region. The registration of DEFI DMCC includes offices in Jumeirah Lake Towers, Dubai, as the company seeks to offer digital asset exchange-traded products (ETPs) through its subsidiary, Valour, which has also opened a trading desk at the Dubai Multi Commodities Centre (DMCC) in the UAE.

As per the press release, the DeFi Technologies team and its subsidiary Valour, aim to support the increased institutional interest in digital assets in the GCC region and specifically in the UAE. As the first Nasdaq-listed digital asset manager of its kind, DeFi Technologies offers equity investors diversified exposure to the broader decentralized economy. This includes Valour, which offers access to more than 65 of the world’s most innovative digital assets via regulated ETPs with plans to offer 100 by the end of 2025.