The Blockchain Group now rebranded to Capital B, listed on Euronext Growth Paris, which became Europe’s first Bitcoin Treasury Company, holding subsidiaries specialized in Data Intelligence, AI, and decentralized technology consulting and development aligning itself with Bitcoin’s founding principles, has announced it plans to expand to the UAE and set up a subsidiary in Abu Dhabi.

As per the press release, the Company noted that it is currently engaged in the process of establishing a subsidiary in Abu Dhabi (UAE) to support the development of Capital B’s Bitcoin Treasury Company strategy. The press release adds that these developments reflect the acceleration of the Company’s Bitcoin Treasury Company strategy, which is focused on increasing the number of bitcoin per share on a fully diluted basis over time.

Capital B also shared its ambitions to create Bitcoin treasure stating that it has already bought 1.955 Bitcoins 64% of the 3,000 it aims to purchase before 2026, with an overall ambition to acquire 250,000 BTC by end of 2033.

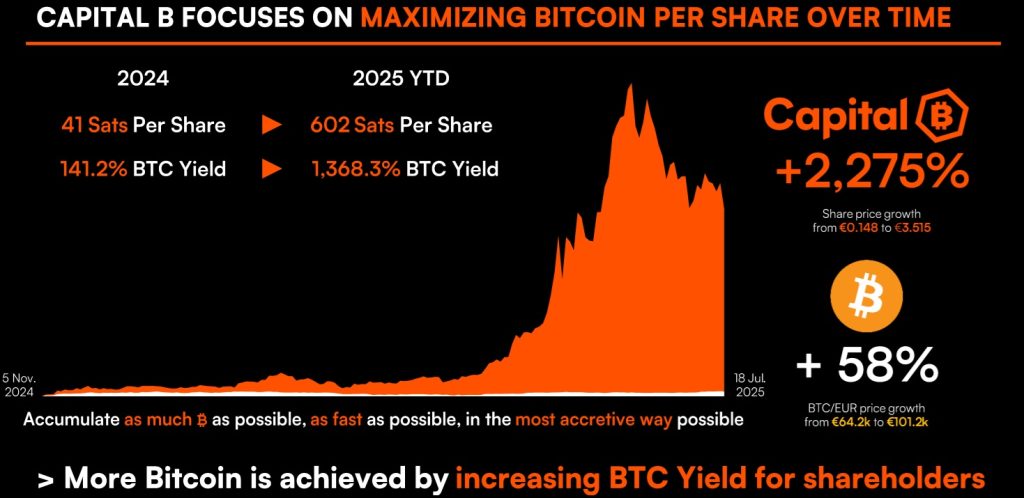

Capital B now considers itself as a Bitcoin treasury company adopting a bitcoin standard in November 2024. In 6 months since adopting Bitcoin as a treasury, Capital B has seen growth of 745% in 6 months and is expecting that this growth will 2,275% at the end of the next 8 months.

Additionally Capital B launched BTC Convertible bonds.

In another press release, Capital B announced that it raised 10.3 million Euros equivalent to $12 million to contribute to the tokenization of the company shared on the platform Stokr allowing it to pursue its Bitcoin Treasury company strategy.

Earlier in the GCC region, Bahrain based Al Abraaj Restaurants Group B.S.C. (Ticker: ABRAAJ) (“Company”), a public listed company on the Bahrain Bourse, announced that it put Bitcoin on its balance sheet. The Group purchased Bitcoin in partnership with U.S. based 10X Capital, becoming the first publicly traded company in the Kingdom of Bahrain, the Gulf Cooperation Council (“GCC”), and the Middle East to acquire Bitcoin as a treasury asset.

Raoul Pal, the Co-Founder and CEO of Real Vision, a financial knowledge and educational platform, in a recent visit and meeting with sovereign wealth funds in the MENA region, specifically in the GCC, found that the mandate is to use AI ( Artifical Intelligence) and Blockchain across the entire region.

In his X video interview, Pal noted, ” A month ago during my last trip to MENA region, and in my meetings with sovereign wealth funds across Saudi Arabia, Qatar, Oman, Bahrain, and UAE, the mandate across entire region from Saudi, Abu Dhabi Bahrain and Qatar is AI and Blockchain and not just using Bitcoin as a reserve asset but building the entire government structure on blockchain, driving licenses, property deeds the whole bloody lot.”