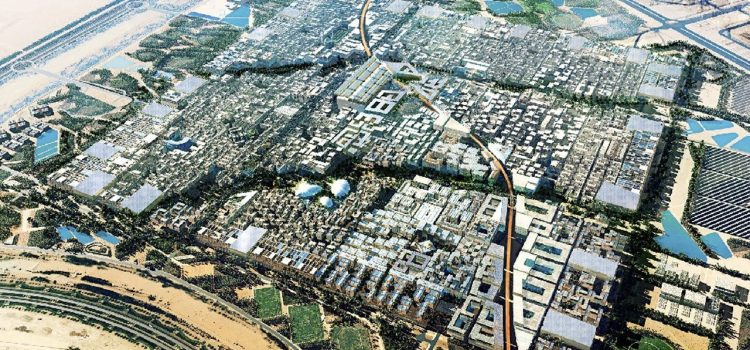

Marathon Digital Holdings in a recent press release has confirmed that the company along with Abu Dhabi based Zero Two (Registered name FS Innovation), an emerging blockchain and digital assets infrastructure development company, will be launching the two digital asset mining sites with a combined capacity of 250 Megawatts in the sustainability hub of Abu Dhabi Masdar City and the port zone of Mina Zayed by the end of 2023.

The joint entity registered in ADGM will work to accelerate the global digital economy while supporting the power grid of Abu Dhabi, JV) with the first large-scale immersion Bitcoin mining operations in the Middle East. To power the sites, Marathon and Zero Two intend to leverage excess energy in Abu Dhabi, increasing the base load and sustainability of the Abu Dhabi grid. Marathon and Zero Two will offset any non-sustainably produced electricity with clean energy certificates.

As per previous articles the equity ownership in the ADGM Entity will be 80% for Zero Two and 20% for Marathon.

To overcome desert climate environmental challenges, Marathon and Zero Two developed a custom-built immersion solution to cool the ASIC miners and implemented proprietary software to optimize their performance. The initial results of the pilot project, which include a significant reduction in the amount of maintenance required for the ASIC miners to effectively produce hash rate, indicate that operating immersion digital asset mining sites in Abu Dhabi is now feasible with the implementation of Marathon’s and Zero Two’s technological advancements.

The mining equipment and infrastructure required to build each site has already been ordered, and construction of both digital asset mining sites is currently underway. Once operational, these sites are expected to be among the most technologically advanced and energy-efficient digital asset mining operations globally. Based on the current construction schedules, both sites are expected to come online before the end of 2023, with a combined hash rate of approximately 7 EH/s.

“Our strategic alliance with Marathon marks a significant milestone for the blockchain and digital assets industry in Abu Dhabi,” said Ahmed Al Hameli, Chief Executive Officer of Zero Two. “This alliance leverages Zero Two’s regional expertise, expansive relationships, and growing blockchain infrastructure development and operational capabilities, with Marathon’s technical prowess in developing digital asset sites and innovative mining technologies. These synergies create a powerful combination and lay the groundwork for the success of this pioneering project in the Middle East. Marathon shares our commitment to actively supporting Abu Dhabi’s power grid and developing global digital assets infrastructure. We look forward to working with them on this venture.”

Fred Thiel, Marathon’s chairman and CEO, commented, “Our collaboration with Zero Two is a pivotal moment for Marathon and one that is consistent with our ethos of operating at the forefront of the technology curve and developing innovative technology solutions to advance the Bitcoin mining industry. For this project, our team successfully co-developed and implemented a full immersion solution, as well as developed proprietary mining software from the ground up to provide flexibility, resilience, and optimization. In Zero Two, we have found a valuable collaborator whose expertise in digital asset infrastructure development, and whose relationships in the region are an optimal complement to our team’s unique ability to build and implement innovative technologies. We look forward to working together to build the next-generation Bitcoin mining facilities in Abu Dhabi.”