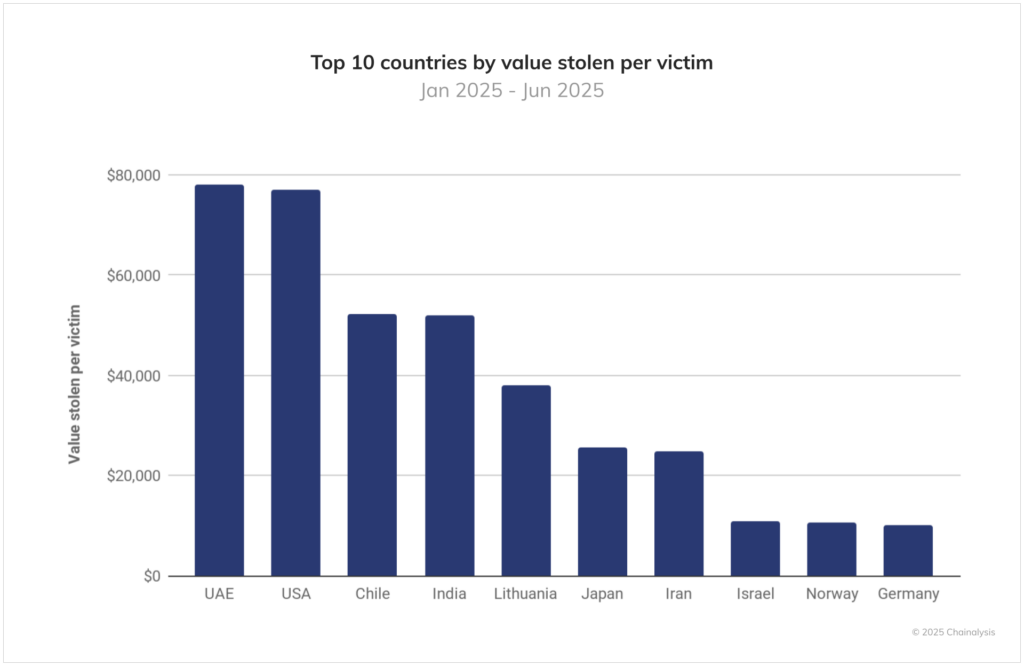

In the recent Chainalysis, 2025 Crypto Crime Mid-year Update: Stolen Funds Surge as DPRK Sets New Records, report the UAE topped the countries globally with the most crypto value stolen from victims, almost equal to the statistics for the USA. The average crypto value stolen per victim was around $80,000.

According to the report over $2.17 billion stolen from cryptocurrency services so far in 2025. So far 2025 is more devastating than the entirety of 2024. The DPRK’s $1.5 billion hack of ByBit, the largest single hack in crypto history, accounts for the majority of service losses.

Furthermore, by the end of June 2025, 17% more value had been stolen year-to-date (YTD) than in 2022, previously the worst year on record. The report noted that if current trends continue, stolen funds from services could eclipse $4 billion by year’s end. While 2022 — previously the worst year on record according to our data — required 214 days to crack $2 billion in value stolen from services, 2025 achieved comparable theft volumes in just 142 days.

Personal wallet compromises now represent a growing share of total ecosystem theft, with attackers increasingly targeting individual users, making up 23.35% of all stolen fund activity YTD in 2025.

Geographically in terms of personal wallet victimizations, which is not comprehensive, in 2025, the U.S., Germany, Russia, Canada, Japan, Indonesia, and South Korea top the list of highest victim counts per country, whereas Eastern Europe, MENA and CSAO saw the most rapid H1 2024 to H1 2025 growth in victim totals.

The report goes on to note that somewhat divergent list of countries emerges when plotting the value stolen per victim in 2025. As shown in the chart below, the U.S., Japan and Germany remain in the top 10, but the UAE, Chile, India, Lithuanian, Iran, Israel, and Norway have some of the highest victimization severity rates globally.

In North America the Bitcoin and altcoin saw the most thefts, while Europe led in Ether and stablecoin theft. As for APAC it ranks second in terms of total BTC stolen, and third in terms of stolen ETH, whereas CSAO ranks second in terms of stolen altcoin and stolen stablecoin value.

Fairly consistently, Sub-saharan Africa ranks the lowest in terms of value stolen (second to last in terms of compromised BTC), which is most likely indicative of lower wealth levels in this region and not necessarily a signal of lower victimization rates among crypto users.

Why UAE tops the globe with crypto value stolen for victims

There are many reasons why the UAE crypto users are losing the most in crypto. First the number of crypto users in the UAE has reached 30% of the population. Secondly UAE between July 2023 and June 2024, received $30 billion in crypto, ranking the country among the top 40 globally in this regard and making it MENA’s third largest crypto economy.

The UAE has also set up a regulatory environment that allows for crypto trading, investment and even payments in AED stablecoins, while being one of the countries in the GCC with the most international mesh of global citizens.

While the UAE is working to deal with crypto crimes either through police or judiciary, citizens using crypto still have to be vigilant about personal wallets, investments, and the crypto exchanges they use.