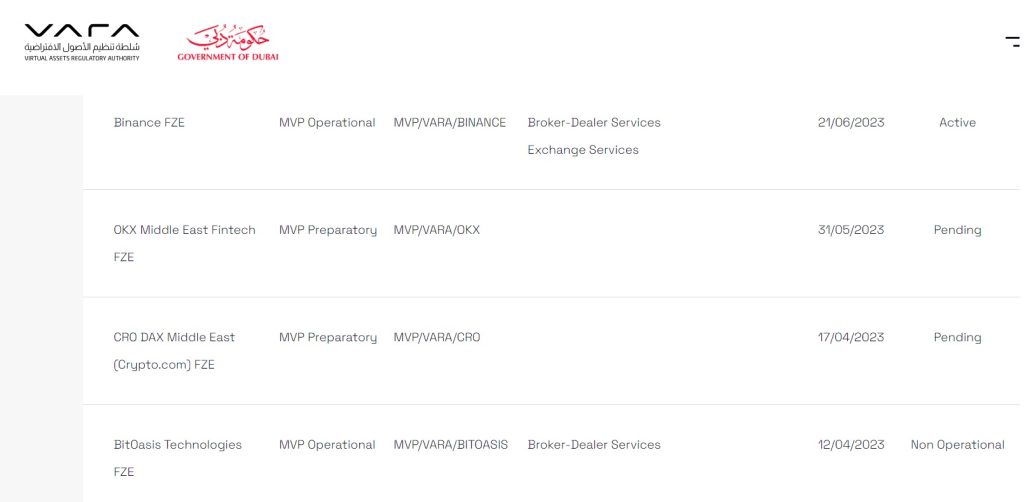

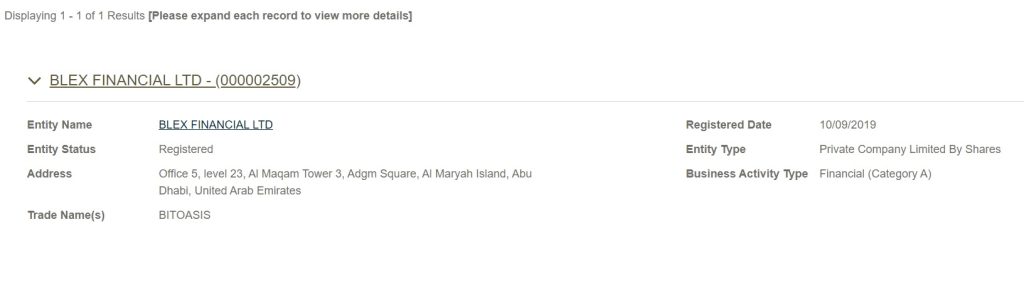

BitOasis a crypto trading platform, which received its license in Bahrain in June 2024, and was acquired by CoinDCX crypto exchange, has now officially launched its operations in Bahrain with regional plans to reach 1 million users by 2026. Since its inception in 2016, BitOasis has processed over USD 7.4 billion in trading volume and raised over USD 40 million in funding. It also holds a license in Dubai UAE.

As per the announcement, BitOasis Bahrain will operate under a Crypto-Asset Services License from the Central Bank of Bahrain, delivering secure, compliant, and robust trading services for retail, corporate, and institutional users. It has also launched a premium services for high-net-worth individuals and institutional clients, featuring exclusive VIP offerings and dedicated relationship support. The platform also supports local bank transfers, ensuring seamless and efficient deposits and withdrawals across the GCC.

Attendees at the launch event were joined by Ali Dashti, the General Manager of BitOasis Bahrain, Ola Doudin, CEO and Co-Founder of BitOasis, and Sumit Gupta, Co-Founder of CoinDCX.

“Today marks a significant milestone as we proudly launch BitOasis in Bahrain,” said Ola Doudin, CEO and Co-Founder of BitOasis. “BitOasis has always stood for trust, providing the best experience for users, and maintaining a robust platform. With the backing of CoinDCX for over a year now, we are accelerating that mission. CoinDCX’s 200+ strong technology team now powers the platform’s backend, unlocking faster performance, deeper liquidity, stronger security, and a significantly enhanced product suite. Our ambition is clear: to reach one million users across the region by 2026, setting the gold standard for compliance, innovation, and customer experience.”.

According to IMARC Consulting, the GCC cryptocurrency market was valued at $744.3 million in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 16.75%. Additionally, approximately 38% of crypto users in the region have annual incomes exceeding USD 15,000, reflecting a strong base of financially empowered individuals.

“For CoinDCX, MENA is not a market to merely enter—it’s a region to co-build. Since acquiring BitOasis in July 2024, we’ve seen tremendous progress. BitOasis secured a full VASP License from VARA in December 2024, and with its launch in Bahrain, we’re further strengthening our regional presence. By joining forces, we’re creating a platform that’s local at heart but global in strength. Our goal is to transform the market, building the most secure, compliant, and future-ready crypto platform in the region,” said Sumit Gupta, Co-Founder, CoinDCX.

.