Burency a UAE Blockchain development firm with crypto asset exchange operating out of offices in DWTC ( Dubai World Trade Center) in Dubai UAE, is restarting its operations after what it calls bad and out of control conditions. This restart is happening amidst a tumultuous conditions spurred by comments made from its previous managing Director.

So while Burency was announcing on twitter that they will be coming back soon stating, “ We are coming soon.. after bad and out of control conditions, we are back to work with great strength and passion. The Burency project is ongoing and will return better than before.”

On August 9th they stated, “ We are currently working on restarting the Burency Exchange and will notify you as soon as possible about the operating date. Full support will be provided to the project at all levels, including marketing, companies, and plans to develop the workflow and the project as a whole.”

However these comments come in parallel to a tweet by Qusai M Alsharef, former Managing Director of Burency. He writes, “Regrettably, I am writing to announce my resignation from my position “Managing Director” at Burency, effective from 2nd August 2023.” He explains the reasons stating, “The continuous violation for the accepted funding plan, coupled with unfulfilled Discussions, words and agreements to the work stakeholders came to really critical stage. It is deeply disappointing to have encountered such unprofessional conduct, including deceptive promises and consistent violation of our established agreements. At the end, I truly wish for Burency to have an honest recovery to right and to see a responsible actions of eliminating all these highly critical issues starting from fulfilling the past.”

Historically Burency had also made announcements that were not fully backed up with real actions. In April 2020, Burency announced that it had launched the first secured & insured crypto-currency exchange platform in Dubai, UAE which was later refuted by Nebbex.

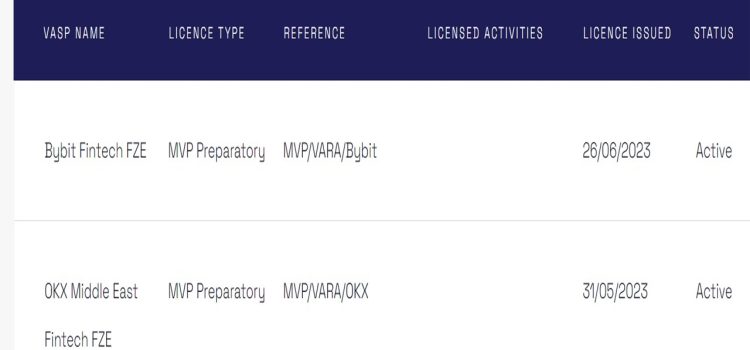

The company while having a tech license in UAE, its crypto business is regulated in Estonia. It had stated it was seeking to be registered in the UAE but to this day has not.

In 2020 crypto advocate, John McAfee, announced that he had joined the advisory board of Burency, but no further announcements or information was shared on this.

So it might seem that Burency wants to come out of the volcanoe stronger than ever, but its past seems to be haunting it to present day.