Liminal, a provider of wallet infrastructure and custody solutions, with a presence in the UAE has launched its compliance solutions suite, with Notabene’s Travel Rule solution.

According to recent news pieces, Liminal’s compliance suite presents features to aid clients with their regulatory obligations, including integration to enable communication between virtual asset service providers, providing an interface to fulfil regulatory obligations, supplying compliance solutions to prioritise data protection, allowing customisation to cater to compliance, and real-time monitoring and alerts to address compliance issues.

Rahil Shaikh, AVP of product and blockchain, Liminal, stated, “We are looking forward to introducing our compliance solutions suite, strengthened through our collaboration with Notabene. At Liminal, our objective is to drive innovation within the digital asset industry, and this partnership aims to reinforce our commitment to providing regulatory-compliant solutions for our clients. By joining forces with Notabene, we seem to have empowered our customers with travel rule compliance.”

Liminal’s latest suite of compliance solutions, coupled with Notabene’s innovative Travel Rule integration, empowers clients with an efficient means to navigate compliance challenges. Liminal’s compliance suite presents a wealth of powerful features to aid clients in meeting their regulatory obligations, including:

a) Seamless Integration: The integration will enable smooth and secure communication between virtual asset service providers, streamlining the sharing of transactional data in compliance with regulatory mandates.

b) Simplified Compliance Processes: Liminal’s suite empowers clients with a user-friendly interface that simplifies the compliance journey. Users can now effortlessly fulfill their regulatory obligations, saving time and resources.

c) Enhanced Security: Security is of paramount importance in the world of digital assets. Liminal’s compliance solutions prioritize data protection, ensuring that sensitive information remains secure throughout the compliance process.

d) Customizable Solutions: Recognizing the diverse nature of businesses operating in the cryptocurrency sector, Liminal’s suite allows customization to cater to specific compliance needs, ensuring flexibility and adaptability.

e) Real-time Monitoring: With real-time monitoring and alerts, clients can proactively address compliance issues, thereby mitigating risks and reinforcing trust with regulatory bodies.

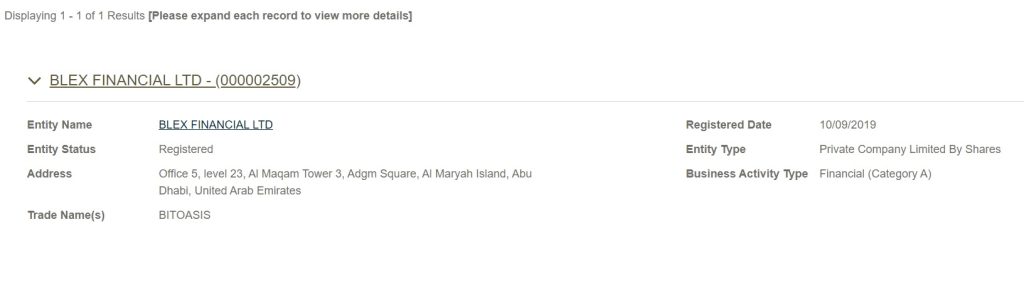

Liminal in May announced that it had applied for a license at at Abu Dhabi Global Market (ADGM) in an effort to offer regulated service in the region. Liminal which claims to have processed crypto transactions worth $5.6 billion on its platform, with over $550 million worth of assets under protection, believes that people will use digital assets either as part of investment or a part of underlying fundamental technology.

Mahin Gupta, Founder, Liminal stated to Khaleej Times, “Regulation will become uniform across the globe. UAE has taken a first mover advantage in the field of digital asset regulation, with much clarity. They have a clear idea about how they want to look at Metaverse, how they want to look at trading, how they want to look at custody and how they want to look at blockchain as a service and blockchain as a platform for other applications.”

Prior to that Liminal partnered with Dubai based payment gateway platform Magik Labs. Through this partnership, Liminal would empower Magik Labs to create a series of transit payment wallets to receive payments from their users. These payments will then be converted to desired tokens or NFTs via connectivity to other decentralized exchange (DEX) aggregators, over the counter (OTC) desks or trading platforms. Liminal’s MPC hot wallets will enable transit wallet addresses and provide automation of transaction flows.

At the time, Manan Vora, senior vice president, strategy and operations at Liminal had noted, “Our partnership with Magik Labs is a part of our continued efforts to strengthen Liminal’s position in the Mena region as the first choice of businesses for digital wallet infrastructure services.”

The compliance solutions suite will be offered to Liminal’s clients, including exchanges, custodians, and institutional investors.