UAE digital assets infrastructure provider Fuze has partnered with Abu Dhabi headquartered Wio Bank to empower its customers with virtual assets trading services.

Customers will be able to buy and sell popular cryptocurrencies such as Bitcoin and Ethereum, directly through Wio Bank’s recently launched application, Wio Personal.

Wio Personal is an intelligent everyday banking application redefining the way individuals see, manage, and grow their money. The personal banking application allows all customers to start investing simply and effortlessly. Wio Personal users can access thousands of global stocks, ETFs, fractional shares and even UAE IPOs seamlessly in a single, integrated app.

Speaking about the significance of the partnership, Jayesh Patel, CEO of Wio Bank PJSC, said, “The region is emerging as an important hub for cryptocurrency and there is a demand from customers for convenient, seamless access to crypto trading services integrated within their daily banking apps. As a business that was created to catalyze the digital banking ecosystem, we are excited at the opportunities this collaboration with Fuze provides, to better serve our customers and support the UAE’s forward-thinking transformation of the financial services sector. Fuze mirrors our own robust governance, compliance, and risk capabilities, so our customers can be confident in having secure access to Virtual Assets.”

Mohammed Ali Yusuf (Mo Ali Yusuf), Co-Founder and CEO of Fuze, added, “As a regulated provider, we are proud to partner with Wio Bank, which has already made tremendous strides in redefining banking for the modern era across the region. There is a clear synergy with our mission to build the future of finance and we look forward to supporting Wio Bank in delivering regulated, trusted crypto services to its flourishing customer base.”

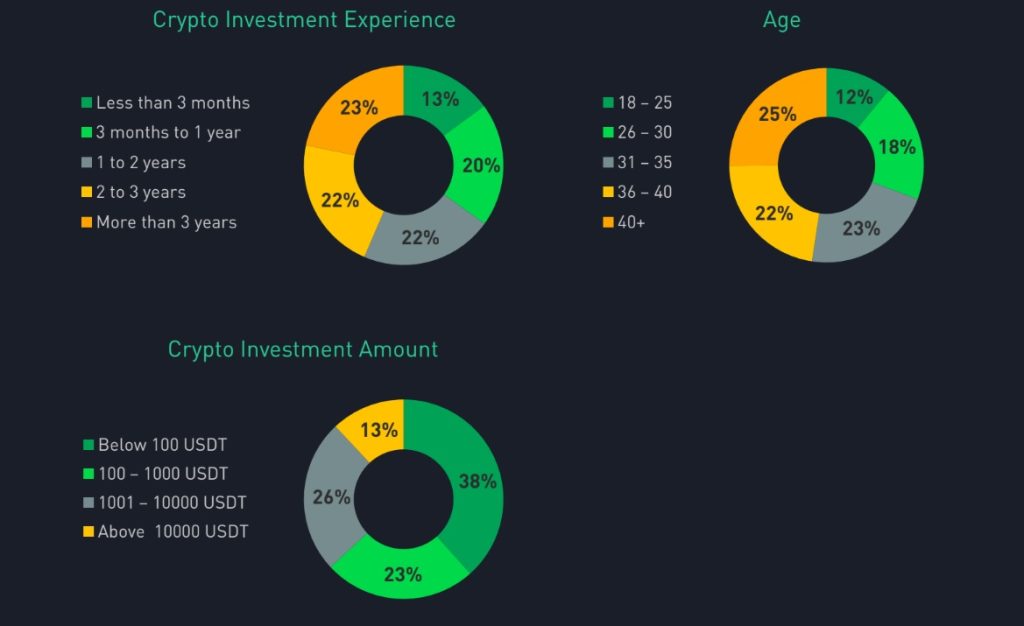

In a recent UAE poll suggested 48% of crypto users lacked trust in crypto exchanges. Through such partnerships, neobanks can provide regulated options for their customers and help to increase trust in the crypto ecosystem.