World Economic Forum report entitled “ Pathways to the Regulation of Crypto-Assets” says UAE crypto asset regulatory framework is an agile one, defining it as flexible, iterative and proactive which is beneficial because it is flexible, appreciate market maturity and ecosystem development.

According to the WEF report, regulators that fall under this model include the Swiss Financial Market Supervisory Authority. FINMA’s token classification prescribes three simple categories: payment tokens, utility tokens and asset tokens. The framework acknowledges hybrid tokens and that a token’s classification may change over time. Following the first classification, FINMA later also published further guidance in

Also included as per the report are the regulatory sandboxes in the EU and India in addition to the UAE.

Instead of prescribing and enforcing rules, agile regulation adopts a responsive, iterative approach, acknowledging that policy and regulatory development is no longer limited to governments but is increasingly a multi-stakeholder effort. Yet it also faces challenges that include the need for coordination and collaboration being as well plagued with uncertainty.

Regulatory sandboxes, guidance and regulators’ no-objection letters are all forms of agile regulation that enable the testing of new types of solutions, iterating policy frameworks based on ecosystem evolution and industry needs.

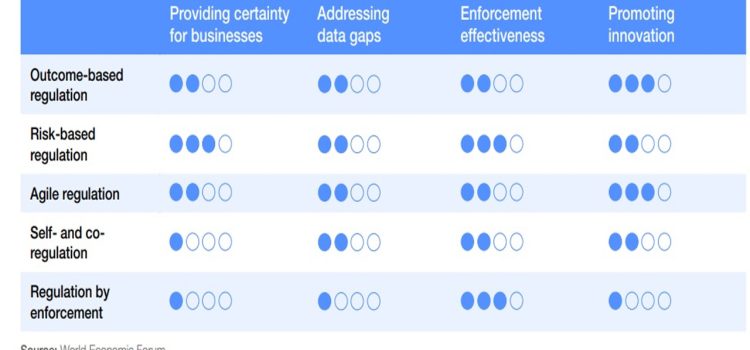

The report sets out to understand and highlight the needs and challenges in developing a global approach to crypto-asset regulation. In doing so, it delves into the various regulatory approaches being adopted by different jurisdictions.

The report developed rankings for each regulatory framework. The rankings covered four areas when analyzing regulatory frameworks and found that the agile regulatory framework is best at promoting innovation. Agile regulatory framework ranks in the middle ground for providing certainty for businesses, addressing data gaps and enforcement effectiveness.

The report finds for example that Regulation by enforcement which the USA falls under is weak in all the above mentioned areas except for enforcement effectiveness.

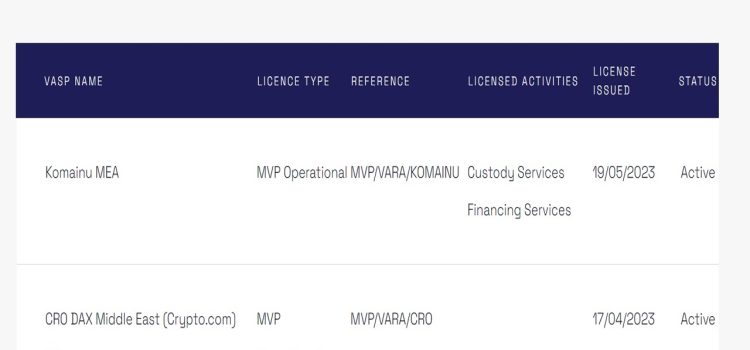

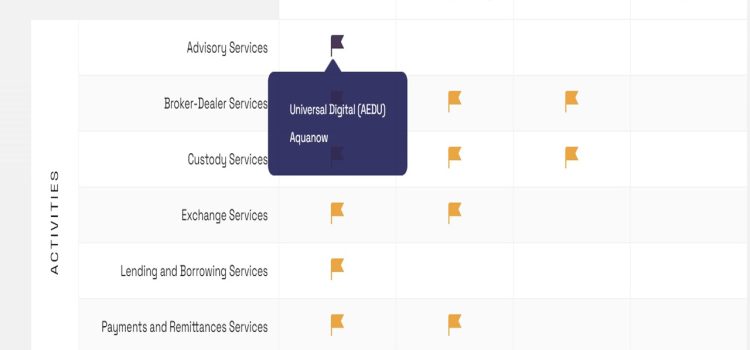

As per the report the UAE has not only initiated a license regime for crypto assets, but has also carried out consultation for decentralized applications such as DeFi, and DAOs.

In addition the report mentions that few jurisdictions have chosen to address the difficulty of classifying tokens, partially relying instead on the functionality enabled by the token.

For example, Liechtenstein has chosen not to rely solely on classifications but to introduce the token as such as an element in Liechtenstein Law, meaning that the right or asset represented in the token triggers the application of special laws (the so-called “token container model”). This means that the tokenization as such has no legal effect: if a financial instrument is tokenized, the financial market laws are applicable if the activity is regulated, too; if a commodity is tokenized, the laws for commodity trading might be applicable; and so on. For new instruments, such as utility coins and virtual currencies, a new regulation has to be defined.

While in the UAE, the Virtual Assets Regulatory Authority in Dubai has put forth a framework that is underpinned by overarching regulations and compulsory rulebooks, segregating activities-based rulebooks to rapidly account for novel products, emerging technologies, and new business models that require regulatory capture.

The paper’s findings reinforce the urgent need for policymakers and regulators to collaborate with industry and users to realize the benefits while addressing the risks involved.

Enforcement is still weak globally. For example in the context of AML supervision of crypto-assets, a Bank for International Settlements (BIS) 2021 survey found that oversight remained nascent globally. As stated, “Although many are at different stages, with some countries still finalizing applicable law and policy and a small portion engaging in active supervision, by and large effective enforcement measures remain a work in progress. The result is a complex tapestry of enforcement trends as well as enforcement risks posed by the cross-jurisdictional influence of crypto-assets.”

Even when it comes to the FATF travel rule implementations are also limited. As noted in FATF’s June 2022 targeted update report, interoperability across technical solutions and across jurisdictions is still lacking.

WEF report as such notes that such fragmented enforcement techniques will pose a challenge to the supervision and monitoring of crypto-assets against regulations in the short term and may take many years to standardize.

The report recommends promoting a harmonized understanding of taxonomy/classification of crypto assets and activities, set out best practices and baseline regulatory standards for achieving the desired regulatory outcomes and encourage passportability of entities and data sharing.

Building on this foundational paper, the World Economic Forum’s Blockchain and Digital Assets team will launch an initiative focused on evaluating the outcomes of different regional approaches to regulation. This effort will convene public- and private-sector leaders to reveal first-hand learning’s and the unintended consequences.

But not everyone shares the WEF reports belief that International crypto regulations and standards are possible. During the Qatar Economic Forum this week, Peter Smith Co-Founder and CEO of Blockchain.com rejected claims of a “United Nations” of crypto as inconceivable. He stated, “A global system to regulate cryptocurrency is unlikely to exist.”

However, the Blockchain chief recalled the recent EU passing of the world’s first comprehensive package as a step forward in cautiously regulating the cryptocurrency industry. In addition, Smith told Bloomberg that regulators that express optimistic calls to crypto would promote development for the industry.

So whether a global harmonic set of crypto assets regulations are formulated or whether regional and national countries work to build their own, the growth of crypto assets cannot be curved by regulators.