In a recent interview with Qatar News Agency, the Secretary-General of Qatar’s Research Development and Innovation Council (QRDI) Eng. Omar Ali Al Ansari affirmed that artificial intelligence (AI) science and the digital revolution related to “metaverse” and “blockchain” are among the most important technological transformations in the current era.

He believes that these technologies are important due to their contributions to the development of scientific research and innovation, through its ability to analyze huge amounts of data and process them faster and more effectively, which leads to the discovery of new patterns in the data and contributes to innovative scientific discoveries.

Al Ansari added that the digital revolution and Blockchain technology will provide new levels of security, transparency and security for information, which contributes to the development of methods of dealing with information and data, storing and exchanging them. It also enhances trust and cooperation and opens new horizons in this field.

As such the council aims to promote technological development by stimulating and nurturing talent, as well as expanding the knowledge of the research and development community in the areas of artificial intelligence, big data analysis, and others.

The Council endevours to provide new opportunities for cooperation with relevant authorities from various countries of the world, with the aim of exchanging information and expertise and promoting scientific and technological progress.

According to Al-Ansari the Council is about to launch a new program package to support innovation in the private sector, as part of the third national development strategy, where it provided new platforms and programs in order to explore innovation opportunities in a limited range of major national companies and some government agencies, which establishes the importance of adopting innovative solutions in order to build new competitive advantages to raise its production efficiency.

Al Ansari explained that QOI program has received, since its launch, more than 400 submissions from innovators across Qatar and the world, all of which focused on the areas of health, energy, environment, transportation, education and smart cities, noting that the council announced during the past months that 9 companies won this grant.

In addition the Product Development Management Program, which is being implemented in cooperation with Qatar Development Bank, has attracted 25 participants from 11 small and medium local companies. About 30 senior government employees (directors and heads of departments) from 10 ministries participated in the Government Innovation Leadership Program. (QNA)

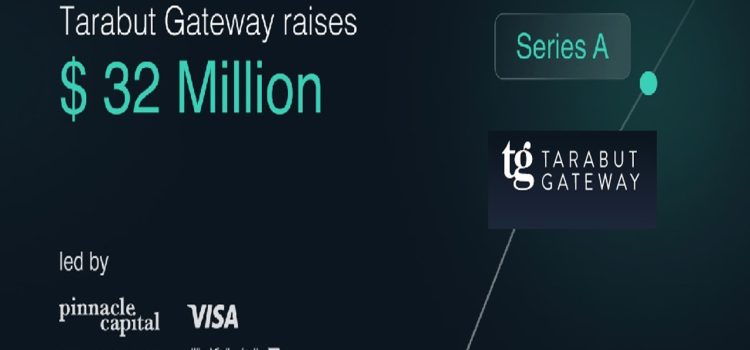

These statements come at a time where, Qatar Genesis Technologies, the developers of the Maxya Blockchain platform, are holding meetings and workshops with banks in Qatar to learn from the experiences of fintech.

According to Mazen El-Masri Cofounder and CEO of Genesis Technologies in a LinkedIn statement, “ A banking-as-a-service approach can be adopted to expedite the move from the monolithic structures of legacy core banking systems into a lighter service-oriented banking solution stack. To achieve this transformation, it is now more important than ever for banks to partner with (or acquire) fintechs with solid innovations and at the same time exploit their existing assets to enable new sources of growth in their reconfigured banking value chain.”

He added, “ With the sponsorship of Qatar Central Bank, we enjoyed a great discussion with the banking sector in Qatar with over 50 attendees. We at Genesis Technologies LLC are enthusiastic about the coming banking/fintech partnership and we expect that it will bring to light the next generation of banks.”

Qatar has been strongly moving forward in its blockchain and digital asset strategy. It seems we will be seeing a lot in Qatar over the next few years.