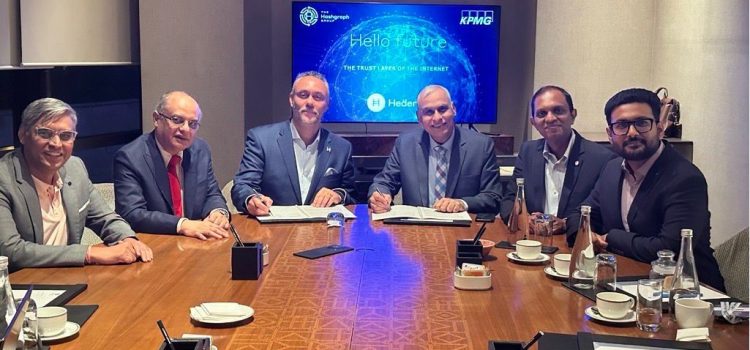

KPMG in India, a professional services firm, and The Hashgraph Group (THG), a Swiss-based international business, venture capital, and technology company operating exclusively within the Hedera ecosystem, have joined forces to accelerate the impact and enterprise adoption of blockchain and Distributed Ledger Technologies (DLT) across industry sectors, leveraging Hedera’s platform capabilities and its enterprise-grade DLT network.

Both entities are expected to collaborate to enable and advance blockchain adoption, thereby aiming to deliver transformative benefits to enterprise clients globally and across various sectors. The strategic alliance is expected to offer co-branded and joint go-to-market solutions, leveraging THG’s Hashgraph for Enterprise (H4E) product suite to enable businesses to benefit from secure enterprise-grade solutions built on the Hedera with service level agreements (SLAs).

Blockchain/DLT implementations are rapidly transitioning from nice-to-have to must-have decisions as we further advance into the future of a decentralized and interconnected Web3 economy. The growing adoption of blockchain/DLT is expected to continue to gain traction for enterprises, with this technology now empowering many industries through its distributed ledger system. The evolution of blockchain/DLT as a technology, to a complete digital infrastructure, showcases its unique abilities to boost security, reduce costs, and enable everyday transactions to be more efficient, affordable, and convenient, while saving energy and meeting environmental, social, and governance (ESG) criteria and reporting requirements.

Speaking on the alliance, Chaitanya Gogineni, Partner, Digital Lighthouse, KPMG in India, said, “We are excited to join forces with The Hashgraph Group to build innovative Digital Ledger Technology (DLT) led tools and enable digital transformation for our clients. This alliance is built on a shared vision of empowering businesses to harness the power of DLT, unlocking new opportunities and creating lasting value.”

The alliance seeks to address critical challenges and enterprise needs in areas such as digital identity (DID), digital product passport (DPP), sustainability, supply chain management, asset tokenization, and more.

Stefan Deiss, Co-Founder & CEO of The Hashgraph Group, stated, “This strategic alliance with KPMG in India represents a pivotal moment in combining the strengths of a leading professional services firm with the technological power of Hedera as the world’s leading layer-1 protocol to enable organizations with Hedera-powered post-quantum enterprise solutions. We are excited to embark on this joint go-to-market journey with KPMG in India and look forward to empowering businesses to compete in the Web3 economy.”

Additionally, the structured collaboration in the productization and commercialization of blockchain/DLT for enterprises, might enable KPMG in India and THG to pool engineering resources, advisory expertise, investments, and strategic Web3 capabilities to serve the growing demand for enterprise ready blockchain-powered solutions, with the achieved synergy expected to strengthen both KPMG in India and THG’s global market presence, while increasing client reach and enhancing service delivery through a joint go to market strategy and unified project execution.

Krishna Tyagi, Head of Web3 at KPMG in India, added, “Today blockchain technology has the potential to revolutionize various sectors by providing secure, transparent, and efficient solutions. Our alliance with The Hashgraph Group is expected to enable us to offer our clients immense value and drive innovation in the digital economy enabled by blockchain technology.”

Anindya Roychowdhury, Head of Global Partnerships at The Hashgraph Group, said: “Having spent a large part of my professional career with KPMG in India, I am delighted to have facilitated this important collaboration. India is emerging as the world’s #1 destination for Web3, and this strategic alliance will establish Hedera as the preferred DLT protocol for governments and enterprises; we have already made significant inroads through our local presence in India and expect to scale massively over the coming years.”

Recently the Hashgraph Group partnered with Taurus to bring tokenization solutions to the MENA region specifically to KSA and UAE.