Chainalysis shared an excerpt from its upcoming 2024 Geography of Cryptocurrency report covering the MENA region and noting that MENA is the seventh largest crypto market globally in 2024 with the biggest two crypto countries being Turkey and Morocco.

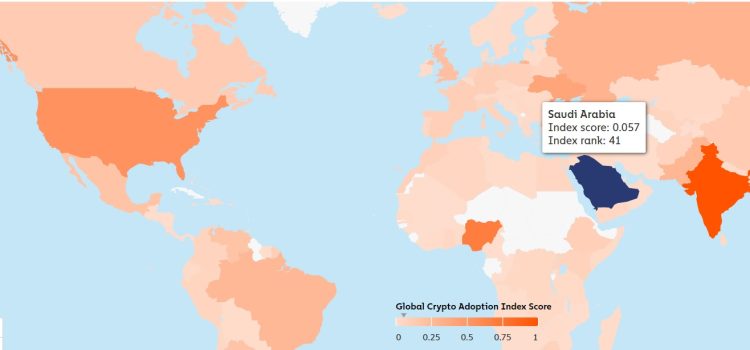

In addition, it noted that the fastest growing crypto countries are Saudi Arabia and Qatar. Saudi Arabia remains the fastest-growing crypto economy in the MENA region, growing by 154% year-over-year, with a focus on blockchain innovation, central bank digital currencies (CBDCs), gaming, and fintech innovation more generally. Qatar follows closely as the region’s second fastest-growing market, growing by 120% year-over-year. It is noteworthy that Qatar recently officially launched its digital assets Lab, as well as digital assets and DLT framework, while Saudi Arabia has been growing and investing in Web3, gaming, AI and Blockchain.

Biggest crypto countries in MENA Turkey and Morocco

The biggest two countries in MENA were Turkey and Morocco. Turkey held 11th position while Morocco 27th where Turkey capture $137 billion and Morocco $12.7 billion.

While the UAE between July 2023 and June 2024, received over $30 billion in crypto, ranking the country among the top 40 globally in this regard and making it MENA’s third largest crypto economy.

In total the MENA region received $338.7 billion in on-chain value between July 2023 and June 2024, accounting for 7.5% of the world’s total transaction volume.

The majority of crypto activity in MENA is driven by institutional and professional-level activity, with 93% of value transferred consisting of transactions of $10,000 or above.

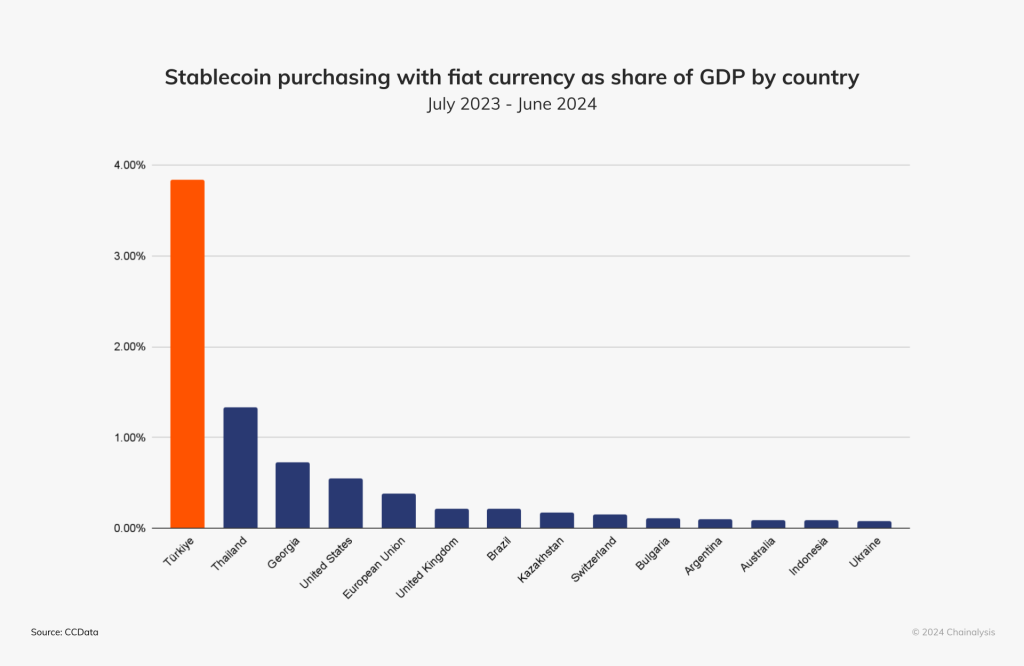

Stablecoins gain traction in MENA

The Chainalysis excerpt also notes that stablecoins and altcoins making gains across MENA particularly in Turkey, Saudi Arabia and the UAE. Turkey is number one in the world in stablecoin trading volume as a percentage of GDP, by a large margin. It’s important to note this measure is not saying that nearly 4% of Turkish GDP is stablecoins, but that stablecoin trading volumes on CEXs are equal to 4% of GDP in dollar equivalent terms, meaning crypto trading volumes could one day exceed a country’s measure of GDP.

Stablecoins consistently represent the majority of crypto assets purchased with the Turkish Lira, approaching nearly $6 billion in purchases in March of this year. Stablecoin purchases with the Turkish Lira are closely correlated with inflation rates.

Ethereum usage in MENA is below global average.

Unlike most countries globally, the UAE’s crypto activity is growing across all transaction size brackets, signaling a more balanced and comprehensive adoption landscape. The country also boasts a diversified crypto ecosystem, with significant activity beyond CEXs, including DeFi. The total value received by DeFi services, including DEXs, grew by 74% compared to last year, and that received by DEXs alone grew by 87%, from an estimated $6 billion to $11.3 billion.

Deepa Raja Carbon, Managing Director and Vice Chairperson of VARA, speaking to Chainalysis about the unique position VARA occupies as a regulator two years after its creation. “We’ve identified over a thousand entities conducting crypto-related activity within Dubai and we’re working through a legacy transition. Over the next year, we expect to see these entities licensed,” she explained, adding that VARA’s approach is one of collaboration rather than blind enforcement. “Both the industry and regulators come to the table with that perspective — to learn together and evolve,” she said, stressing the importance of balancing market protection with innovation.