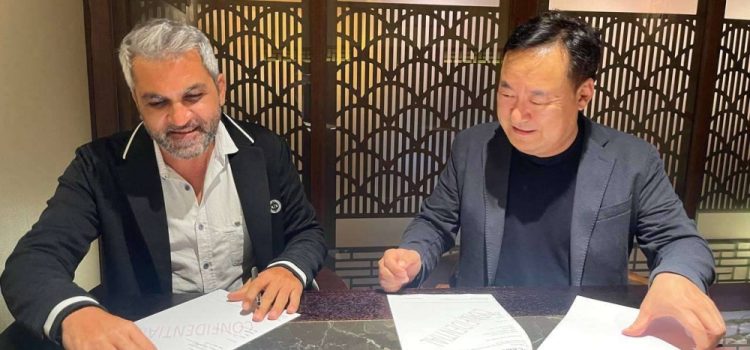

Dubai based cyber security firm, FearsOff has partnered with HTX crypto exchange and Poloniex crypto exchange to secure and protect those crypto exchanges.

This partnership aims to improve HTX and Poloniex’s existing security infrastructure with asset and data protection by integrating FearsOff’s specialized expertise while ensuring the safety of user assets and data by addressing specific security challenges collaboratively.

According to the recent Kucoin Survey , The Cryptoverse, Understanding Crypto Users in the UAE, which revealed insights into the UAE’s role as a crypto hub, it was found that 48 percent of UAE crypto users are concerned about lack of trust in crypto exchanges, with 63 percent of them prioritizing security

The Chief Operating Officer at FearsOff, Marwan Hachem, commented “We’re thrilled to partner with HTX and Poloniex, and commend their leadership for taking proactive measures to be one step ahead of future threats. Often, the best defense is a good offense; this collaboration enables us to identify and neutralize potential vulnerabilities before malicious hackers can exploit them, thereby preventing future breaches.”

Prior to its official Dubai debut in 2022, the FearsOff core team of veteran ethical hackers collaborated for over 15 years on hundreds of projects. One key to FearsOff’s success is integrating deep research into innovative, proprietary tools and software, enhancing assessment capabilities.

This comes as more and more exchanges in the UAE are receiving regulatory licenses.