As expected The Qatar Financial Centre (“QFC”) Regulatory Authority (“Regulatory Authority”) and the Qatar Financial Centre Authority (“QFC Authority”) have published a consultation paper for their digital assets framework which seeks to regulate investment tokens.

QFC is seeking feedback for the proposed digital assets legislation at a date no later than January 2nd 2024 which means the final legislation will not be available until the first or second quarter of 2024. This comes at the heels of QFC’s launch of its digital assets Lab which will be launched on October 29th.

Aditya Kumar Sinha, Head Fintech & Digital Innovation at Qatar Financial Centre (QFC) Authority · states on LinkediN, “ The Qatar Financial Centre Regulatory Authority (QFCRA) and the Qatar Financial Centre (QFC) Authority have jointly released a Consultation Paper, and we’re seeking your insights and feedback on our proposals to introduce a QFC Digital Assets Framework. This comprehensive framework is being developed in phases, with phase one dedicated to establishing legislation for a QFC tokenization framework. To make this vision a reality, the QFC Regulatory Authority and QFC Authority have meticulously prepared a range of draft legislative instruments.”

As part of the digital assets legislation is rulebook for Investment Tokens. These rules define the treatment of investment tokens representing specified products, making their activity subject to authorization and supervision, and amendments to existing rules to accommodate investment tokens.”

The Regulatory Authority and the QFC Authority has developed a QFC digital assets framework designed to achieve the following objectives, develop a legal and regulatory framework for digital assets through the establishment of a tokenization framework in the QFC that will provide legal certainty and a trusted technology environment for digital assets; provide legal recognition of digital assets and address issues such as ownership of the underlying assets, custody arrangements, the transfer of ownership, trading and exchange of digital assets, smart contracts, among other relevant matters.

It also seeks to develop a trusted technology infrastructure that embeds the standards necessary to ensure trust and confidence among consumers and support for the framework from high quality service providers; and develop a framework that delivers certainty and promotes trust and confidence in digital assets, the market, and the service providers.

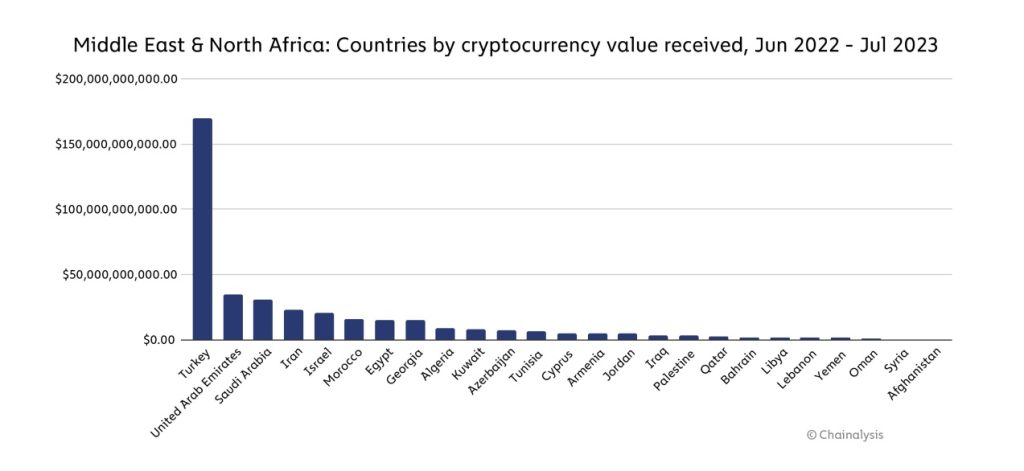

QFC authority as mentioned based their proposed framework on benchmarks in Lichtenstein, Switzerland, the European Union, the Monetary Authority of Singapore, various states, and offshore financial Center frameworks in the GCC and other benchmark regulatory jurisdictions.

Henk Jan HoogendoornHenk Chief Financial Sector Officer at Qatar Financial Centre (QFC) Authority added in a post on LinkedIn, Our ambition is to have a solid Digital Asset Framework where real Asset can be tokenized with trusted tokenization partner and supervised by Qatar Financial Centre (QFC) Authority and Qatar Financial Centre Regulatory Authority (QFCRA) .”

As per the documents the proposed digital assets framework is being developed on a phased basis with phase one focusing on the establishment of legislation to provide for a QFC tokenization framework.

In terms of investment tokens, they are tokens that represent underlying’s that are Specified Products under the QFC Financial Services Regulations (“FSR”). They provide for any person who carries out an activity in relation to such a token to be conducting a regulated activity, requiring authorization and supervision by the Regulatory Authority.

So what is the Investment Tokens Rules 2023? It introduces enabling provisions for tokenizing rights (described as investment tokens), in specified products under the QFC Financial Services Regulations (“FSR”) and certain derivatives and Islamic financial contracts declared to be specified products in Regulatory Rules.

Stablecoins, CBDCs, and crypto are not under the regulatory guidelines and as such are prohibited. As per the legislation framework, “

As noted a cryptocurrency token that is used as an alternative to fiat currencies but is not issued or backed by any governmental authority and does not represent any ‘off-chain’ property, is an example of an excluded token. This includes tokens commonly referred to as fully backed stablecoins, as these are regarded as substitutes for currency but are not themselves fiat currency or monetary instruments.”

Yet regulated token services include token validators, token generation services, token custody services, operation of a token exchange, and token transfer services fall under the activities within the digital asset framework.

In addition the proposed amendments to the Special Company Regulations enable Special Companies to conduct the additional activity of issuing certificates, receipts, or other instruments, which would include tokenized instruments. This amendment is proposed on the basis that parties conducting a transaction in digital assets from the QFC (i.e., by way of example, a sukuk or bond Token issuance) may use a Special Company for this purpose.

This comes after QFC has commenced working with blockchain, DLT, and consultancies to develop their digital asset and DLT framework infrastructure.

This week Dubai’s DIFC (Dubai International Financial Center) also released its digital assets consultation paper.