UAE based ADNEC Group, an events management company, will be holding the first Bitcoin MENA Conference in partnership with Bitcoin Magazine and Capital events. The Bitcoin MENA Conference 2024 is set to take place December 9-10th in the heart of Abu Dhabi at the ADNEC Centre Abu Dhabi.

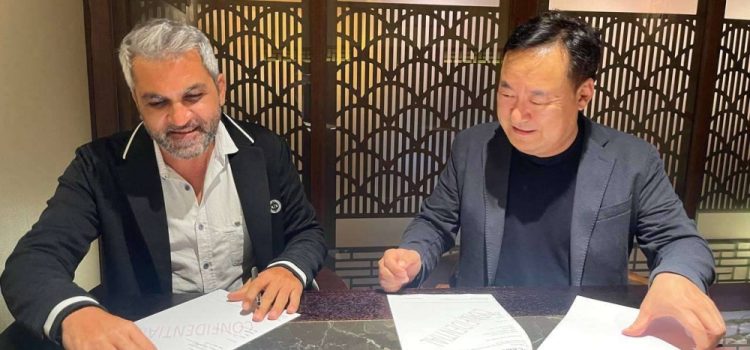

The event will be co-organized by Capital Events, the event management arm of ADNEC Group, and BTC Inc., the parent company of Bitcoin Magazine and the Bitcoin 2024 conference. The seminal partnership was cemented by a high-profile signing ceremony between Humaid Matar Al Dhaheri, MD and Group CEO of ADNEC Group and David Bailey, CEO of BTC Inc. The launch of this event marks a significant milestone in the world’s largest Bitcoin conference’s expansion into the investment-friendly, dynamic, and rapidly growing MENA region.

Humaid Matar Al Dhaheri Managing Director and Group CEO of ADNEC Group said: “Organizing this conference in the Emirate of Abu Dhabi reinforces its status as a regional and global epicenter for cryptocurrencies. It provides the region with a crucial platform for dialogue, discourse, and the sharing of knowledge and insights in this domain, contributing to shaping the sector’s regional trajectory for the future. The strategic collaboration with BTC Inc. to host the inaugural Bitcoin MENA Conference underscores the increasing global interest in investing in decentralized digital currencies in recent years. This partnership reflects our anticipation of future growth trends within this leading investment field.”

The Bitcoin Conference, produced by BTC Inc., is the world’s largest and most globally recognized conference brand dedicated to advancing the understanding and adoption of Bitcoin and blockchain technology. With a mission to foster collaboration and innovation, the conference brand brings together key stakeholders from across the global Bitcoin ecosystem to shape the future of Bitcoin and exhibit the latest developments, technology, and services.

Throughout this two-day event, participants will delve into the potential, challenges, and innovations within the developing Bitcoin ecosystem. Showcasing an impressive roster of expert speakers and influencers in the Bitcoin space, Bitcoin MENA is set to present a dynamic agenda complete with engaging keynote sessions, interactive discussions, and insightful workshops on key industry topics. These include the emergence of a new wave of banking and finance within the Bitcoin space, the dynamics of Mining, and the competition for energy dominance, along with insights into open-source initiatives tailored for the technical minds in the Bitcoin community.

Additionally, Bitcoin MENA 2024 will offer a variety of networking opportunities, fostering meaningful international and regional connections among participants whilst also providing a platform to showcase cutting-edge innovations and the latest developments in Bitcoin technology and services.

David Bailey, CEO of BTC Inc. noted, “Across our ecosystem, we have seen a significant upsurge in interest to enter the MENA region. When visiting Abu Dhabi, it became clear that it had all the right ingredients – infrastructure, investment, bold vision, and global access – to provide a perfect home for the international Bitcoin community to tap into the boundless opportunities this vibrant region has to offer. Capital Events and ADNEC Group are the ideal partners to collaborate with us on this journey as they bring world-class infrastructure and deep connections within the region to help supercharge growth and quickly establish Bitcoin MENA as the region’s go-to event.”

Darren Johnson, CEO of Capital Events added, “We are extremely excited to be partnering with BTC Inc. on this vital launch of Bitcoin MENA. Abu Dhabi’s increasing adoption of blockchain technology and friendly progressive regulatory environment have resulted in several high-profile industry licenses being awarded, thereby firmly positioning Abu Dhabi as the optimal hub for the flourishing adoption of Bitcoin in the region. It was clear early on in our discussions with BTC Inc. that we shared the same vision of creating an exceptional world-class event that would serve as a cornerstone in the region’s thriving Bitcoin landscape. We are confident that their deep specialist experience and global industry connections, coupled with our multi-sectoral experience and regional footprint, will make for a memorable launch and long-term growth.”