Egyptian based GIZ Deutsche Gesellschaft für Internationale Zusammenarbeit GIZ which works in Egypt on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ). to support the Egyptian Government’s Sustainable Development Strategy (SDS) has partnered with SIG, a leading packaging solutions provider and Egyptian based Plastic Bank on a blockchain enabled project for recycling waste.

Egypt generates more than 95 million tons of waste annually and currently only 60% of this waste is collected, with less than 20% of that being properly disposed of or recycled.

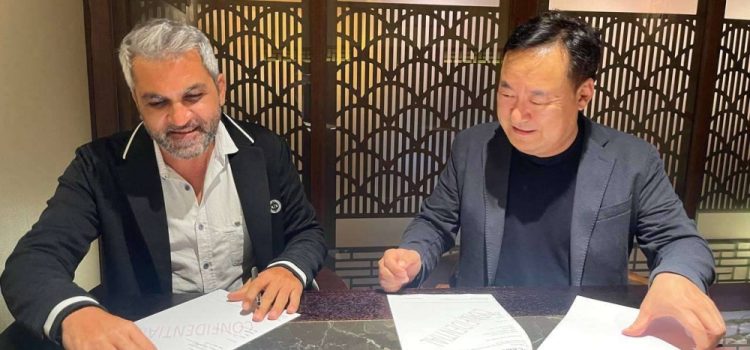

The partnership between SIG, GIZ Egypt, and the social enterprise Egyptian Plastic Bank aims to address this pressing issue and achieve positive change.

In a three-year initiative, the partners are on a mission to collect 700 metric tons of beverage cartons, while also aiming to improve the livelihood for around 1,000 local waste collection members via blockchain.

The PlasticBank app, backed by the social enterprise’s proprietary blockchain-secured platform, provides traceability and transparency in waste collection, empowering waste collectors to convert every piece of discarded material into a source of revenue.

Waste collection members will be able to log each collected product via the app to earn incentives deposited directly into their digital wallets and gain access to social benefits, including health, work and life insurance, digital connectivity, grocery vouchers, school supplies, and more. Furthermore, the waste collection members will undergo training and receive personal safety equipment for their well-being at work.

By streamlining and tracking the collection and recycling of waste, including used beverage cartons, this project also takes a broader role for laying the groundwork for an extended producer responsibility (EPR) model in Egypt. It aligns closely with the Egypt Waste Management Regulatory Authority to weave recycling into the legislative framework and underscores the important role of packaging manufacturers in environmental stewardship.

Abdelghany Eladib, President & General Manager India, Middle East and Africa at SIG stated, “Our new partnership goes one step further in accelerating our progress towards a circular economy. Extending social waste collection and recycling programs like this one in Egypt will help to achieve our goals and is a blueprint for future programs. By establishing a recycling system for beverage cartons in the Greater Cairo area and beyond, SIG is focused on reducing the environmental impact und creating a market for recycled paper.”

This project is supported by the German Federal Ministry for Economic Cooperation and Development (BMZ) funding program “develoPPP” and its special initiative “Decent Work for a Just Transition”.