Blockchain Agritech company, Dimitra, is working with Saudi Sustainable Union Trading company (SUT), an organization that develops innovative agriculture solution to establish a program for Jazan Coffee producers with Connected Coffee Platform for 700 farms.

Dimitra and SUT aim to promote the coffee industry within the country. By assisting in developing coffee farms in the Jazan region of Saudi Arabia, these farmers can further capitalize on their unique coffee heritage in Saudi Arabia.

The Jazan Coffee Cooperative (CCJ), a leading agricultural development institution and national expertise house in the agriculture sector, is using Dimitra’s Connected Coffee platform. The tailored Blockhain enabled platform provides straightforward, actionable insights to increase the quality and quantity of coffee yields, all sustainably and with longevity in mind. The platform also offers real-time track and trace capability throughout all levels of the supply chain, ensuring farmers’ produce is transparent and credible.

The project’s initial phase starts with 200 farms in 2023 and will reach 350 by the end of 2024. The project’s full scope is to implement the Dimitra Connected Coffee platform for 700 farms in 6 coffee provinces in the Jazan region that cultivate Arabica and Khawlani coffee beans.

Specifically, Dimitra’s Connected Coffee platform will help the farmers establish quality control measures. It will also assist with monitoring and maintaining the quality of coffee produced. Moreover, it will also encourage farmers to adhere to international quality standards. The app will also motivate farmers to consider obtaining certifications such as organic to enhance marketability.

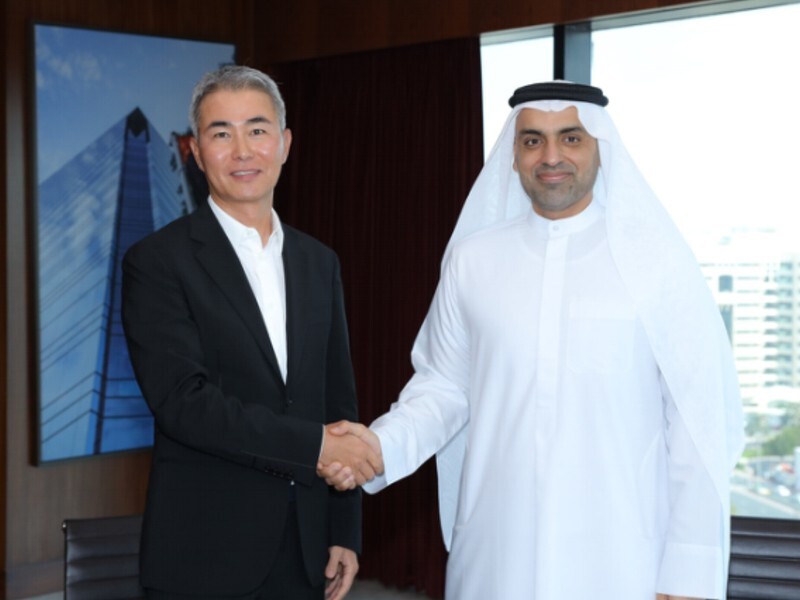

Maged Elmontaser, Dimitra’s MENA regional Director, says, “The Jazan province is packed full of advantages. The six mountainous governorates have many investment opportunities, especially in agriculture and heritage sites. Exploring opportunities to integrate coffee farms into the Dimitra Connected Coffee platform will transform the coffee industry. In addition, it will revolutionize the history, cultivation, and brewing of Saudi Arabian coffee. They are leveraging knowledge exchange, access to markets, and improving the overall competitiveness of Saudi Arabian coffee”.