Crypto.com is now fully operational in the UAE after receiving the final approval from Dubai’s virtual asset regulatory authority VARA. It is the first international crypto exchange to receive a full operational license.

Crypto.com announced this achievement on X formerly Twitter stating that it would now be able to serve institutional investors.

The post stated, “We’re excited to announce our full operational approval from Dubai’s Virtual Assets Regulatory Authority. Crypto․com Exchange will be available for institutional investors as our first launch in the region.”

Crypto.com, has announced that its Dubai entity, CRO DAX Middle East FZE, has received full operational approval from Dubai’s Virtual Assets Regulatory Authority (VARA) and is launching the Crypto.com Exchange for institutional investors as its first operational milestone.

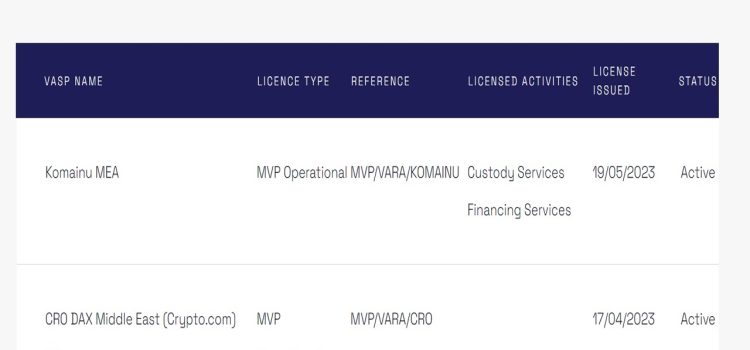

This operational approval follows Crypto.com’s fulfillment of the pre-operational conditions stipulated in the Virtual Asset Service Provider Licence granted to CRO DAX Middle East FZE in November 2023, and marks a first for a global crypto operator to be operational with fiat in the UAE.

Crypto.com will be able to offer exchange Services, broker-Dealer Services, management and Investment Services and lending and Borrowing Services to institutional and retail clients.

Available to institutional clients and qualified retail investors, the Crypto.com Exchange, which has deep liquidity and a state-of-the-art matching engine, offers spot trading, staking brokerage and other OTC offerings around settlements for selected markets. With this full operational approval, Crypto.com has also initiated plans for further in-market product launches expected in the coming months, including the Crypto.com App and additional retail-user focused products.

“We are thrilled to expand our presence and offering in the UAE with the support of VARA,” said Eric Anziani, President and Chief Operating Officer of Crypto.com. “Launching with our world-class Crypto.com Exchange institutional services will be fundamental to our continued growth and success in such a key market for our company.”

“We are incredibly supportive of the steps Dubai is taking to progress the crypto industry, both in-market and abroad,” said Stuart Isted, General Manager, Middle East and Africa of Crypto.com. “But this is still just the beginning, and we look forward to continuing to work closely with VARA in our collective efforts to effectively and responsibly advance the sector.”

In November 2023, Crypto.com received its license but was not operational until all requirements were met. Prior to this OKX received its license which is still non-operational.