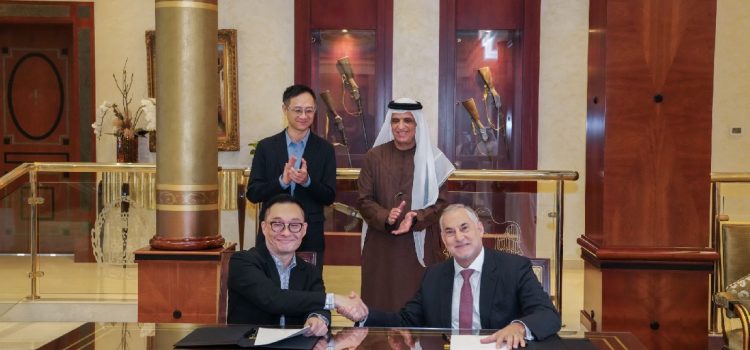

U.S. based Sustainable Bitcoin Protocol (SBP), which aims to unlock Bitcoin’s potential to become the most transparent and sustainable asset has appointed UAE national, an entrepreneur and pioneer in nuclear energy technology, space industry and digital assets Ali AlNuaimi.

Ali Alnuaimi, will hold the position of advisor at Sustainable Bitcoin Protocol. As per the Xpost of SBP, “Ali brings a wealth of experience to Sustainable Bitcoin Protocol. His visionary leadership in launching the UAE’s 1st nuclear reactor & integrating blockchain technology into the energy & financial sectors is a testament to his expertise in sustainable #energy & technological innovation.”

The post adds, “Ali’s pioneering work in leveraging blockchain for energy sustainability aligns perfectly with the company’s objectives, promising to accelerate the adoption of #cleanenergy solutions in bitcoin mining.”

AlNuaimi holds other advisory roles in well renowned entities in the digital asset, AI and Blockchain fields. He is an advisor at Buildr.ai, Marathon Digital, Gigaenergy, and Mysten Labs, the creators of Sui Blockchain.

He is also the Founder and Managing Director of AI firm Shafra.

SBP enables investors to hold verifiably sustainable BTC through the introduction of a new environmental commodity derived from clean energy bitcoin mining, called the Sustainable Bitcoin Certificate (SBC). SBC are paired with BTC 1 for 1 by investors. SBC financially incentivizes Bitcoin miners to use verified clean energy sources.

Finally, SBP’s certificate allows Bitcoin to become fully sustainable with transparent clean energy use without disrupting the fungibility of BTC.

Sustainable Bitcoin Protocol is turning environmental sustainability into an appreciating commodity, in turn supporting clean energy bitcoin miners and helping investors reach their ESG goals.

SBC are a new environmental commodity specifically designed to align Bitcoin mining with climate action. SBC incentivize verified clean energy use and waste methane mitigation, as well as mobilize capital from investors toward the energy transition.

The SBP aims to bring in new revenue and energy transparency by mining Bitcoin with clean energy.

UAE has become a hub for Bitcoin mining, whether with Marathon Digital in Abu Dhabi, or Phoenix Technology, could this be the starting point for digital assets mining, using nuclear energy available in Abu Dhabi?