The Central Bank of UAE (CBUAE) unveiling its new symbol for the UAE’s national currency, the Dirham has committed to the launch of the Digital Dirham as a CBDC. The CBDC project launched in 2023 has witnessed huge progress and will incorporate a Digital Dirham wallet. As per the press release, it seems that the Digital Dirham is already being used for B2B purposes and will be issued for retail segment in fourth quarter of 2025.

As per the press release the new Dirham Symbol and Digital Dirham will strengthen UAE’s positions as a leading global financial hub. The Digital Dirham was a key initiative the Financial Infrastructure Transformation (FIT) Program and was incorporated by Federal Decree-Law No. (54) of 2023 amending certain provisions of Federal Decree-Law No. (14) of 2018 concerning the Central Bank and Regulation of Financial Institutions and Activities which considers the Digital Dirham as a legal tender in all payment outlets and channels alongside the physical currency.

H.E. Khaled Mohamed Balama, Governor of the Central Bank of UAE, said, “We are proud to unveil today the new symbol for the UAE’s national currency the “Dirham” in both its physical and digital forms, and the design of the Digital Dirham wallet. This reflects the significant advancements in the implementation of the Digital Dirham program and a leap towards realizing the CBUAE’s vision.”

UAE Digital Dirham CBDC Benefits

Built on Blockchain technology, the CBDC will incorporate high levels of security and efficiency and will be used for tokenization purposes as well as payments on smart contracts for complex transactions.

Banks, financial institutions, exchange houses, finance companies and fintech companies will issue the Digital Dirham CBDC to both individuals and businesses.

The Central Bank of UAE has also developed an integrated and secure platform for the issuance, circulation, and use of the Digital Dirham, the Digital Dirham wallet. The wallet will enable a number of financial transactions, including retail, wholesale, and cross-border payments, money transfers and withdrawals, top-ups, and redemption of the Digital Dirham when needed. This ensures a seamless and convenient user experience, in line with industry best standards and practices.

Balama also explained that the Blockchain based Digital Dirham will enhance financial stability, inclusion, resilience, and combatting financial crime. He also noted that it would further enable the development of innovative digital products, services, and new business models, while reducing cost and increasing access to international markets.

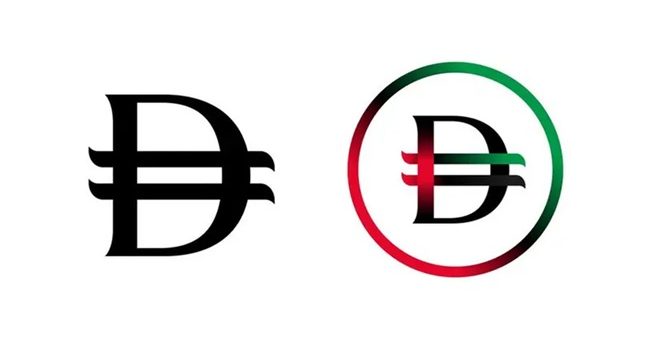

The Dirham Symbol both in physical and digital format

As for the new Symbol it will be applied for both the physical form of the currency and the digital form. The letter was chosen, derived from the English name of the Dirham, to serve as an international symbol representing the nation’s currency, incorporating two horizontal lines that embody the stability of the UAE Dirham and inspired by the UAE flag, to enhance financial and monetary stability.

On the other hand, the Digital Dirham symbol features a circle surrounding the physical currency symbol, using the colors of the UAE flag to reflect pride and national identity. The symbol choice serves as evidence of the national currency’s global reach and openness to a more prosperous future, and commitment to developing an innovative local financial ecosystem with a global perspective.

Paul Kayrouz, Chief Fintech Officer at Central Bank of UAE, noted in a Linkedin post, that the launch is a new era for Fintech in the UAE. He stated, ” We unveiled the new symbol for the UAE Dirham (AED), a major step in strengthening the currency’s digital and global presence. This symbol will streamline financial transactions, enhance recognition in international markets, and support the UAE’s vision as a global fintech and financial hub.”

UAE had previously also issued regulations for AED backed stablecoins that would also be used as legal tender in the country. With the launch of the Digital Dirham, the UAE becomes the fourth country to have launched a CBDC out of 134 countries who are either researching, piloting, canceling or have inactive CBDCs.

The announcement comes as nearly a third of central banks have pushed back launching digital versions of their currencies, a new survey Official Monetary and Financial Institutions Forum (OMFIF) think tank and German-based banknote firm Giesecke+Devrient showed in February 2025, although a desire to protect their money-minting powers mean most still intend to go ahead.

U.S. President Donald Trump banned work on a digital dollar in one of his first moves after becoming president in January.