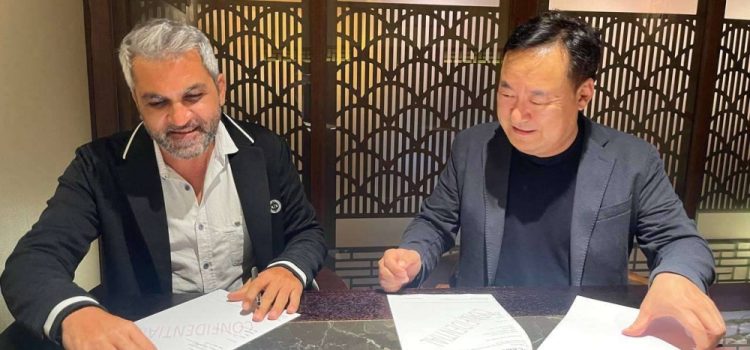

The homegrown Qatar Blockchain startup, Genesis Technologies has partnered with South Korean Blockchain company CP Labs.

Genesis Technologies and CPLabs are set to play a role in realizing Qatar’s Vision 2030 for a digital economy. The collaboration aims to deliver unparalleled security and resilience against cyber threats, underscoring the importance of robust blockchain solutions in the ever-evolving digital landscape.

Speaking at the signing ceremony in Doha, Richard Yun, the head of the business division at CPLabs, highlighted the company’s extensive experience and leadership in the blockchain domain. Yun stated, “As Korea’s first blockchain technology company, CPLabs has been at the forefront of commercializing blockchain based on the experience and expertise accumulated since the early days of blockchain technology in 2013. Furthermore, we aim to drive future changes in digital assets, which are essential elements of digital transformation, through blockchain technology. With 327 blockchain-related patents held worldwide, we have established ourselves as a complete IT solutions provider and are growing into a successful provider of solutions for government and institutional blockchain adoption.”

Yun further emphasized CPLabs’ commitment to navigating the challenges of the GCC market stating, “The GCC market presents another challenge for CPLabs. Being the only local blockchain company in Qatar, our partnership agreement with Genesis Technology, a startup at QU, holds great promise for both parties to enter the local government agencies and markets jointly. We got attracted to collaborate with Genesis Technologies because they share an innovative mindset as we do. Furthermore, we are committed to providing unlimited support and playing a leading role in contributing to the development of blockchain technology in Qatar.”

Mazen Al-Masri, the CEO of Genesis Technologies, echoed similar sentiments, expressing excitement about joining forces with CPLabs. “We are thrilled to collaborate with a well-established and innovative company like CPLabs that is a pioneer in the world of blockchain. Both companies share a similar vision to enable the digital transformation of business, government, and society, leading to a more secure, intelligent, and high-performing world. We will join efforts to produce best-of-breed solutions that respect local regulations and serve the local context effectively.”

This comes soon after Genesis Technologies unveiled two innovative software as a service offerings during their participation at the Web Summit in Qatar in February 2024.