The UAE AI camp a five day camp organized by both the National Programme for Artificial Intelligence, in collaboration with the National Programme for Coders which targets school and university students, includes six cutting edge including web development and robotics, digital entrepreneurship and career planning, generative artificial intelligence, online safety and cybersecurity, blockchain and cryptocurrency, and virtual and augmented reality through interactive workshops, webinars, and deep dialogues in the field of artificial intelligence.

Omar bin Sultan Al Olama, Minister of State for Artificial Intelligence, Digital Economy, and Remote Work Applications and Director-General of the Prime Minister’s Office, stated that the UAE government, led by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister, and Ruler of Dubai, is keen to on fostering a generation empowered with cutting-edge technology and artificial intelligence, enabling them to actively contribute to creating a sustainable digital economy while bolstering the nation’s leadership and readiness for the future.

According to Al Olama, this collaborative effort aims to equip the UAE AI camp participants with digital tools and technologies, enabling them to enhance the framework of future prospects and leverage artificial intelligence solutions in innovative ways.

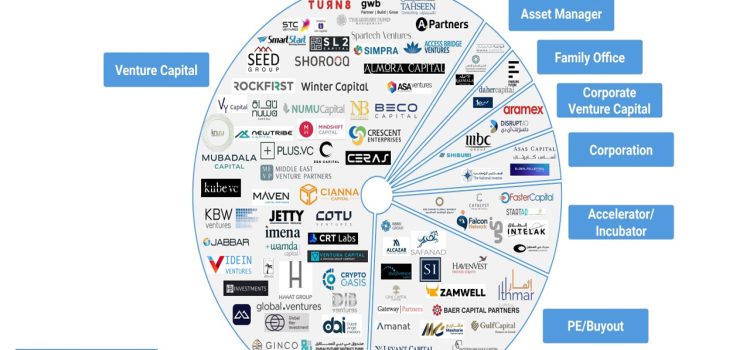

This year, the camp offers specialised programmes and interactive workshops with the participation of a group of government entities, private sector and international companies such as Cyber Security Council, Abu Dhabi Global Market (ADGM), DP World, Dubai Chambers, Road and Transport Authority (RTA), Dubai Cyber Innovation Park, Dubai International Financial Centre (DIFC), coding ambassadors, one of the Coders HQ initiatives, Sharjah Entrepreneurship Centre, Technology Innovation Institute, Ajman X, Fujairah Police GHQ, Microsoft, AWS, Huawei, Careem, Dell Technologies, Stripe, Accenture, Le Wagon, Jeel code, VR Academi, Bnb, Mathworks, University of Birmingham Dubai, Cybernet , 42, Women in AI, Intel, QUAE, Marses robotic systems and others with the aim of providing participants in the camp with future skills.

The UAE AI Camp will continue until the beginning of August 2023. It aims to explore the field of artificial intelligence and digital technologies, shaping the future of technology and digital life through awareness workshops. These workshops will focus on developing participants’ skills in programming, designing artificial intelligence applications and smart applications. Additionally, in-depth workshops will cover various areas such as generative artificial intelligence, deep learning, and machine learning.

The camp also includes meetings for those interested in computing aimed at sharing the experiences of leading companies in the field of artificial intelligence. Workshops will be conducted to discuss the power of artificial intelligence, image and language generation and understanding, as well as how to utilise artificial intelligence tools in our daily lives. Participants will also have the opportunity to learn how to create 3D designs using reality technology.

Additionally, workshops will discuss the challenges in the world of cryptocurrencies and blockchain technologies.

Those interested can register for various workshops through https://ai.gov.ae/aicamp5/.